Top 10 HELOC Lenders for 2025

As you own your home longer, pay down your mortgage, and make home improvements, you build equity. Just as your home was used as collateral for your original mortgage, that same equity can serve as collateral for future loans, known as HELOCs (Home Equity Lines of Credit).

Related searches

A HELOC works similarly to a credit card: you can borrow against it as needed and make payments over time. Unlike a standard home equity loan, which is a lump sum, a HELOC gives you the flexibility to borrow and repay as you go within a set period. Since HELOCs are secured by your home, they typically come with lower interest rates compared to unsecured credit options like credit cards. This makes them a great choice if you’re looking to consolidate higher-interest debts or need a financial cushion for a period of time. Here are 10 of the best HELOC lenders to consider:

1. Bank of the West

A subsidiary of BNP Paribas, Bank of the West offers HELOCs with no origination or closing fees for loans up to $2 million. You can apply both in person at a branch or online, making it a convenient choice for homeowners.

2. Homeside Financial

Based in Maryland, Homeside Financial operates in 22 states. They offer a simple online application process and reportedly excellent customer service. However, there’s a $495 origination fee and a minimum draw requirement of $10,000.

3. Bank of America

With Bank of America, you can start off with a low introductory rate of 3.74%, which jumps to 5.9% after the first year. Despite this increase, it’s still a competitive rate, and there are no origination, annual, or closing fees to worry about.

4. CitiMortgage

For those who prefer banking online, CitiMortgage, a division of Citibank, provides convenient HELOCs with the added perk of discounts for Citibank customers. You can also benefit from automatic payment options when you link your HELOC to your Citibank account.

5. PenFed Credit Union

Available for up to $400,000, PenFed Credit Union offers HELOCs with relatively low fees. While they primarily cater to military families, anyone can apply by making a $17 donation to become a member.

6. Bethpage Federal Credit Union

Located in New York, Bethpage Federal Credit Union offers a 3.99% introductory rate for the first year, which then climbs to 5.25%. One downside is the relatively high minimum draw of $25,000, but the rates remain competitive.

7. SunTrust

SunTrust stands out for its flexibility, allowing customers to convert part or all of their HELOC balance to a fixed-rate option. This can be a big benefit for homeowners looking to lock in a stable payment plan.

8. Third Federal Savings and Loan

Based in Ohio, Third Federal Savings offers a competitive 4.49% APR after a modest $65 origination fee. Known for excellent customer service, it’s a top choice for many homeowners.

9. PNC

A national HELOC lender, PNC stands out for its customer satisfaction, particularly for its flexible terms. They offer fixed-rate options with terms ranging from five to thirty years, giving homeowners a variety of payment plans to choose from.

10. Connexus Credit Union

Though primarily serving Minnesota and Wisconsin residents, Connexus Credit Union allows anyone to join for just a $5 donation. They offer a competitive variable APR of 3.5%, with the added benefit of flexible repayment terms based on 1.5% of your balance.

Why Choose a HELOC?

HELOCs can be a valuable financial tool, offering you flexible access to funds with lower interest rates compared to unsecured options. Whether you're using the line of credit to pay off high-interest debts, fund home renovations, or cover unexpected expenses, choosing the right lender is key to making the most of your equity.

Trade Show Display 2.0: Next Level Tactics for Brands That Refuse to Blend In

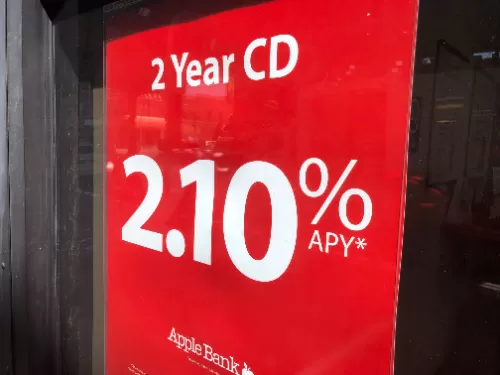

Maximizing Your Savings with High Yield CD Accounts

Unlock Your Financial Potential: Explore Consumer Finance Options Today!

Revolutionizing Borrowing: The Rise of Loan Apps

The Best Credit Cards For Bad Credit In Peloponnese

Mortgage Lending for Foreign Investors: A Guide to Financing with Lendai