Top Small Business Loan Options You Should Consider Today

Starting or expanding a small business can be challenging, especially when it comes to securing the right financing. Luckily, there are various small business loan options available, even for those with limited credit history. Here’s a breakdown of the best options for fast, easy, and low-interest small business loans in the USA.

Related searches

Small Business Loans With No Credit Check

If you’re worried about your credit score, there are lenders that provide small business loans with no credit check. These loans can help businesses get the funds they need without the hassle of a strict credit review. They are a great option for entrepreneurs who may have struggled with credit in the past but are eager to get their businesses off the ground.

Fast Small Business Loans Available Online

For those who need quick access to funds, fast small business loans online are perfect. These loans allow you to apply and get approved without stepping into a bank. Many online lenders offer same-day or next-day approval, ensuring that you can cover your business expenses swiftly and continue operating without disruption.

The Best Small Business Loans in the USA

Finding the best small business loans USA can feel overwhelming with the number of options available. However, looking for lenders with low interest rates, flexible terms, and fast approvals is a great way to start. National lenders as well as local credit unions often provide favorable terms for businesses of all sizes, so be sure to compare options and read reviews before applying.

Loans for Startup Businesses

For entrepreneurs just starting out, securing financing can be particularly challenging. Small business loans for startups are designed to cater to new businesses that need capital for operations, inventory, or marketing. These loans often have flexible terms, with options for businesses that have been operating for only a few months or are still in the planning stages.

Easy Approval Small Business Loans

Getting approved for a loan doesn’t have to be difficult. Some lenders specialize in offering easy small business loans approval, making the application process simple and quick. These loans often have more lenient requirements and can help businesses of all types, even those with minimal documentation or revenue history.

Small Business Loans With Low Interest Rates

Interest rates are a crucial factor when choosing a loan. Small business loans low interest can make a significant difference in how much you repay over time. By focusing on lenders offering competitive rates, businesses can save on interest costs and reinvest those savings into growth and expansion.

In conclusion, whether you need a fast loan, low interest, or startup-friendly financing, there’s a solution out there for every business. Be sure to research and find the loan that best fits your business’s needs.

The Rise of Cryptocurrency and Why It Matters Today

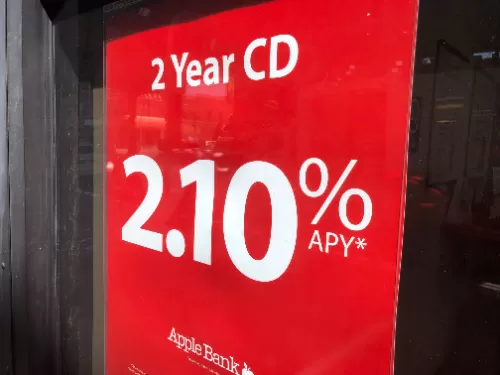

Navigating the Terrain of CD Rates: A Guide to Maximizing Your Savings

Navigating the Landscape of Medical Loans in the United States

The Rise of NFTs: A Digital Revolution in 2024

Transform Your Outdoor Space: Why You Need a Professional Deck and Fence Company

The Current State and Analysis of Credit Card Installment Payments