Navigating the Road to Auto Ownership: Understanding Auto Loans

In the realm of automotive dreams, the path to owning your dream car often intersects with the world of auto loans. For many, purchasing a vehicle involves seeking financial assistance in the form of an auto loan. Understanding the nuances of auto loans is crucial in making informed decisions and ensuring a smooth journey towards owning your desired vehicle.

Related searches

Understanding Auto Loans

Auto loans, also known as car loans or vehicle financing, are financial products designed to help individuals purchase a car. These loans allow borrowers to spread out the cost of a vehicle over a set period, making it more manageable to afford. Typically, auto loans cover the purchase price of the vehicle, including taxes and fees, and borrowers repay the loan amount plus interest over time.

Types of Auto Loans

Auto loans come in various forms, each tailored to meet the diverse needs of borrowers. One common type is the traditional secured auto loan, where the vehicle itself serves as collateral for the loan. Secured loans often offer lower interest rates, making them an attractive option for many buyers. On the other hand, unsecured auto loans do not require collateral but may come with higher interest rates due to the increased risk for the lender.

Factors Influencing Auto Loan Rates

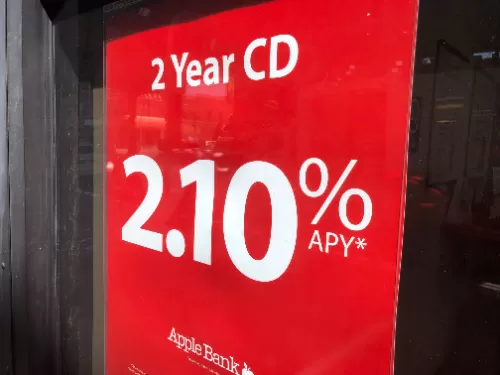

Auto loan rates, often expressed as Annual Percentage Rates (APRs), play a significant role in determining the overall cost of borrowing. Several factors can influence auto loan rates, including the borrower's credit score, loan term, and the economic environment. Generally, borrowers with higher credit scores are eligible for lower interest rates, reflecting their lower risk profile to lenders.

Securing Favorable Auto Loan Terms

Securing favorable auto loan terms requires careful consideration and preparation. Start by assessing your creditworthiness and taking steps to improve your credit score if necessary. Shopping around and comparing offers from multiple lenders can help you find the best rates and terms suited to your financial situation. Additionally, making a larger down payment or opting for a shorter loan term can lower your overall borrowing costs and accelerate your path to ownership.

Responsibly Managing Auto Loan Payments

Once you've secured an auto loan, it's essential to manage your payments responsibly to avoid financial strain and maintain good credit standing. Create a budget that includes your monthly loan payments and prioritize timely payments to avoid late fees and negative marks on your credit report. Consider setting up automatic payments or reminders to ensure you never miss a payment.

In the journey towards auto ownership, understanding auto loans is paramount. Whether you're a first-time buyer or a seasoned car owner, navigating the complexities of auto financing can be simplified with knowledge and preparation. By understanding the types of auto loans available, factors influencing loan rates, and strategies for securing favorable terms, you can embark on your journey with confidence, knowing that you're making informed decisions every step of the way.

Understanding Cash Loans in the USA

Trade Show Display 2.0: Next Level Tactics for Brands That Refuse to Blend In

Mortgage Lending for Foreign Investors: A Guide to Financing with Lendai

Digital Business Advertising: A Guide for Seniors

Navigating Debt: Effective Solutions to Improve Your Financial Health

Best Tax Filing Services: File Your Taxes Fast & Maximize Your Refund